Blackburn Rovers allowed their Head of European Scouting, Glyn Chamberlain to seek pastures new last week. This blog piece seeks to explain some of the possible reasons for this and why it is that most Championship clubs will see the European scouting roles to be a luxury that not many can afford.

This is also a kind of Championship-specific version of the excellent Rory Smith piece in the New York Times, in which he discusses the stagnancy at the very top of the transfer market. His newsletter is well worth subscribing to as well.

I said in my last blog that clubs should be using any and all means necessary to recruit the appropriate players for the roles that they need to fill in their squads. Until relatively recently the avenues available to clubs in the UK, even lower league clubs in the EFL, were fairly broad. Most transfers were, of course, within the domestic market (we will talk about this more later) but the more ambitious or adventurous clubs could go out into Europe and recruit players from practically anywhere in the EU under the freedom of movement. This led to a fair few transfers coming into the country from areas such as Portugal, Germany, Austria, France and Belgium, amongst others.

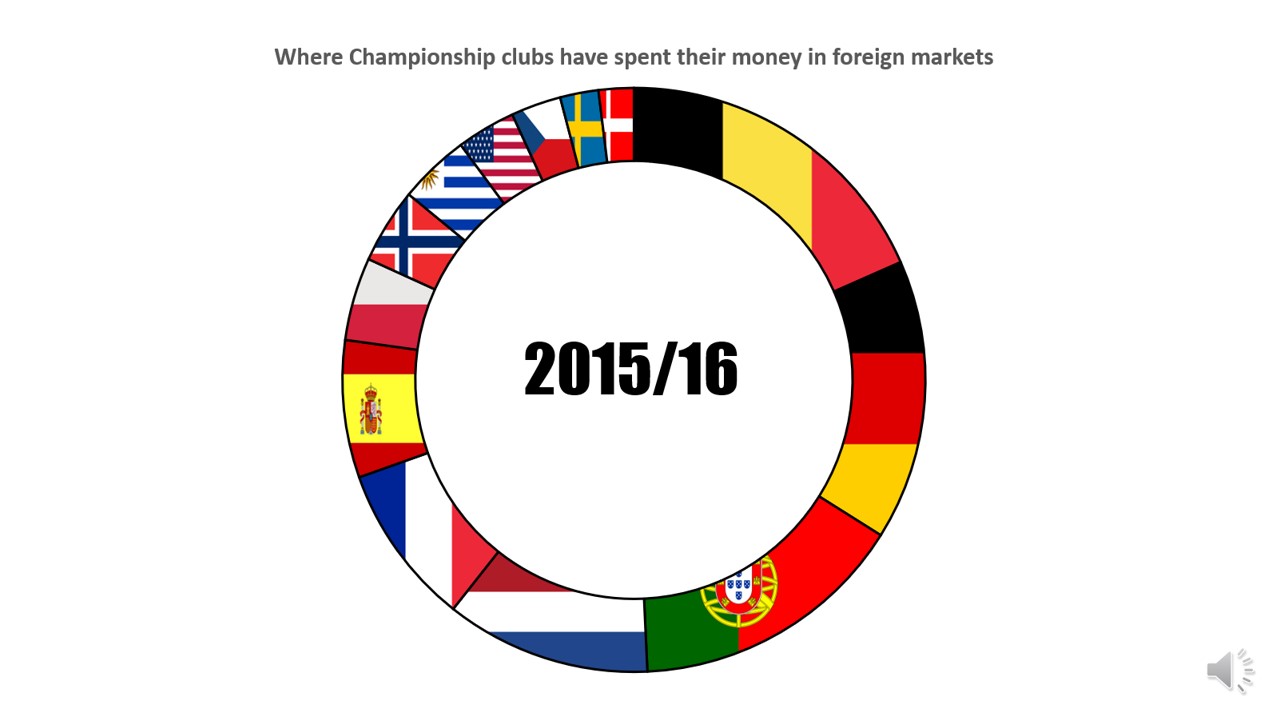

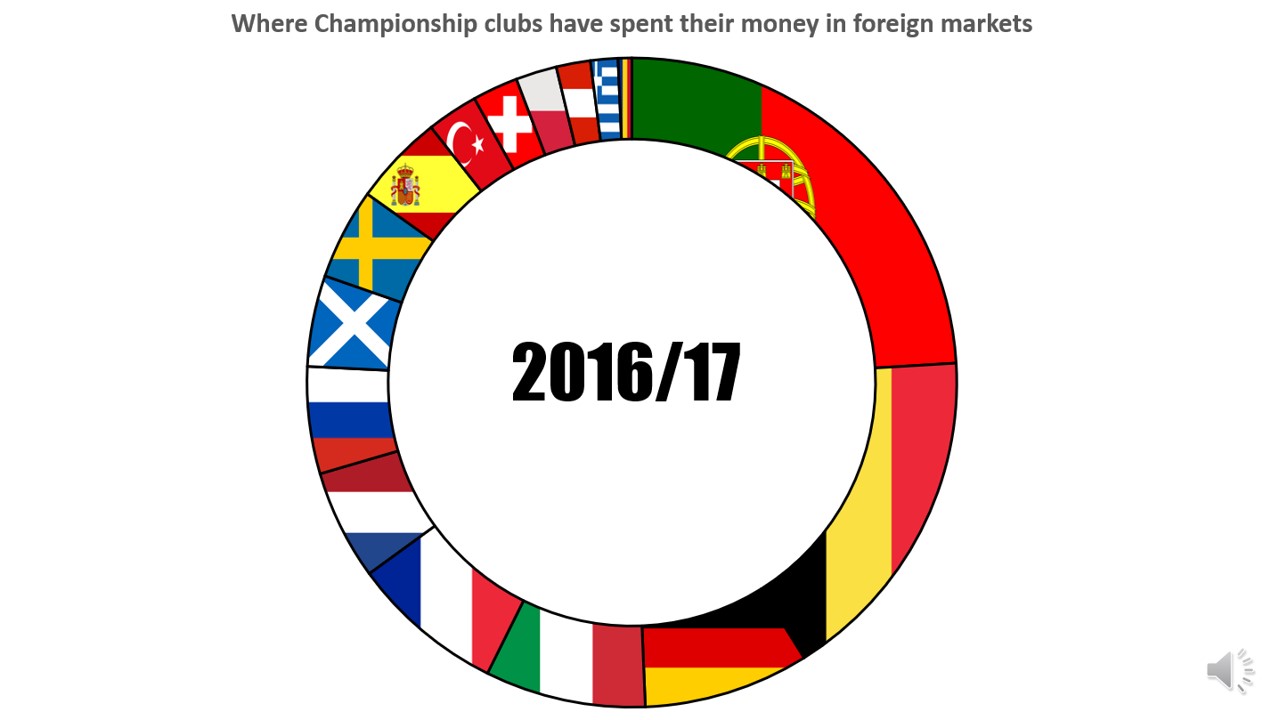

Just to give a quick illustration of where Championship clubs would spend their money in foreign markets I did a couple of basic donut charts last year when researching this topic.

We will go into more depth in this piece in terms of the actual spend and share of the market taking into account domestic transfers as well, but what these images do illustrate is the amount of business pre-Brexit that was being done in EU territories.

The Mendes-inspired Wolves recruitment had a massive effect through 2016-2019 as Portugal was the chief territory for Championship imports. However, the wide variety of countries that Championship clubs used as shopping areas really was quite vast. Let’s now have a deeper look at the GBE rules that have changed this.

Governing Body Endorsements

When Brexit was confirmed it was always going to have an effect on football and recruitment, it was just a question of waiting to see how the FA were going to handle it. They have ended up producing a points-based system in which a player coming into the country to play football has to accrue 15 points across the criteria in order to receive a GBE (work permit) to be allowed permission to register with a club in England.

Regular followers of my work will be familiar with my images from the work around GBEs. However, it is worth re-iterating the situation as it stands. Any player who plays international football for a top 50 FIFA ranked country will get a GBE (depending on how many minutes they have played) and also players from Band 1 and Band 2 leagues are also highly likely to qualify.

Any league below Band 2 it becomes trickier. However, Band 3 leagues are interesting because importing players from these territories (Brazil, Argentina, Russia, Mexico) was all but impossible before Brexit. This is an interesting new avenue for PL and EFL clubs and we have seen Middlesbrough experiment with this with the exciting signing of Martin Payero. However, as we will see later, this is a risk that very few English clubs have attempted so far.

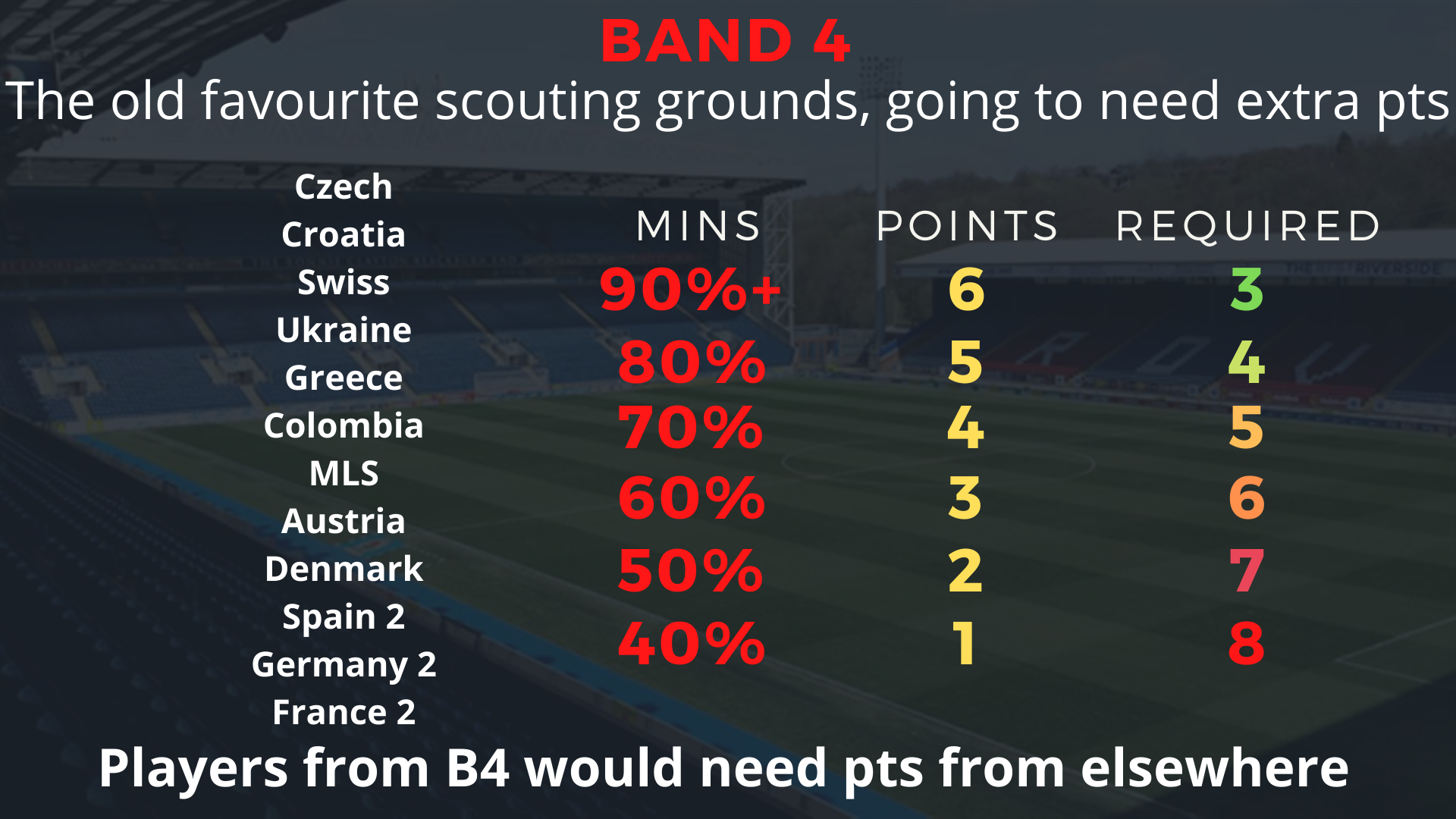

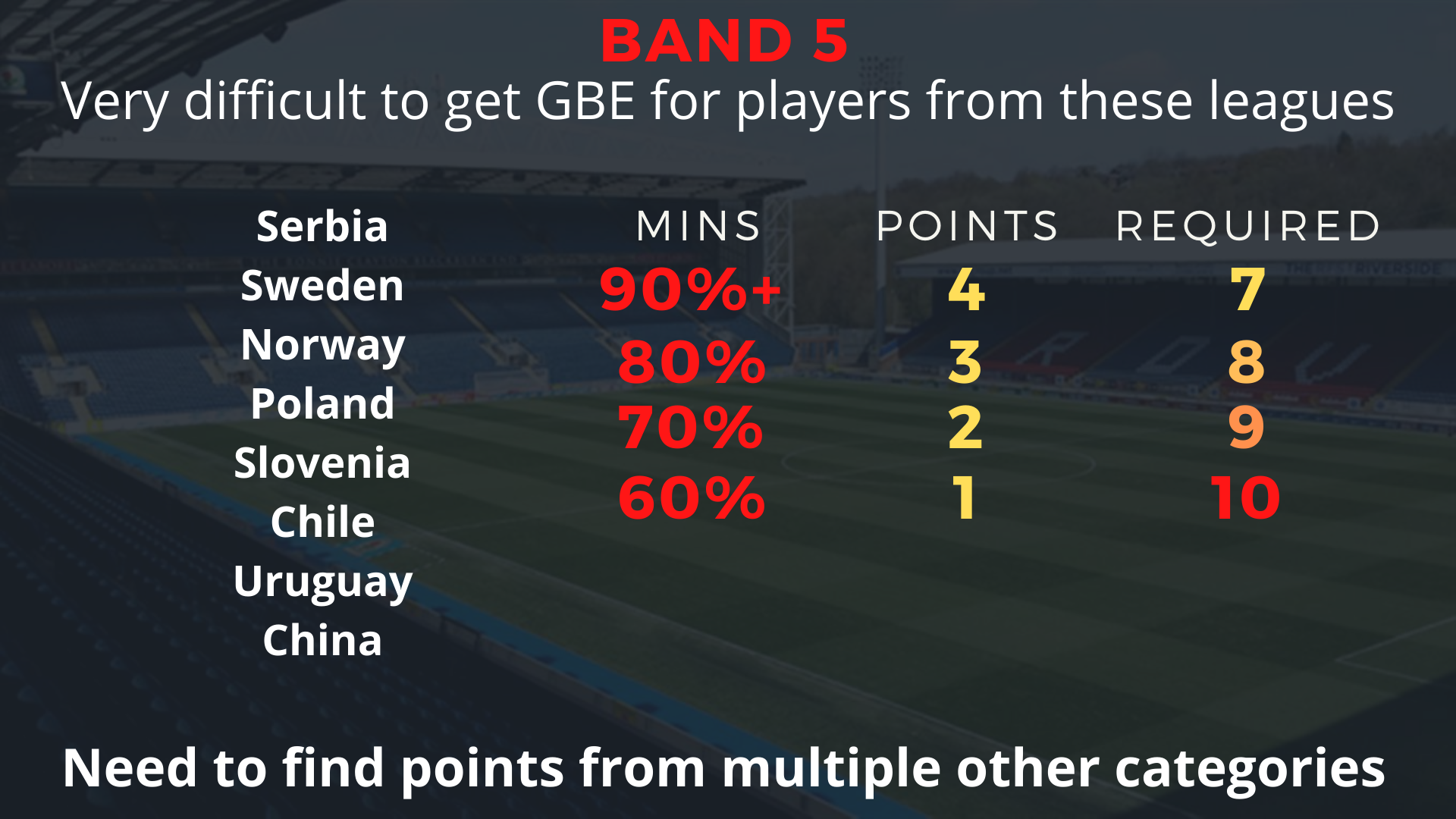

Most of the “value” shopping areas that clubs were beginning to explore pre-Brexit (Central Europe, Scandinavia, 2nd divisions of big countries) are to be found in Band 4/5. Any player that is of interest for English clubs in these divisions need extra points.

Those points may come from continental competition (Champions League, Europa League, Conference League). It is worth English clubs keeping a close eye on which teams progress to the group stages and beyond of the main competitions to see which team’s players might become available for a GBE.

As you can see though, the market available to the vast majority of clubs in the UK has been reduced overall. From a situation where the whole EU (27 countries, plus the likes of Switzerland & Norway ~45 leagues of potential Championship talent if including some 2nd/3rd tiers) was full of potential options we now have a situation whereby only eight European leagues are realistic hunting grounds. For Championship clubs that is realistically reduced to Band 2 leagues (Holland, Belgium, Turkey & Portugal) unless targeting fringe players in one of the Big 5 leagues. So that is a reduction of around 80% of potential players in Europe that are available to sign. That’s pretty huge.

You can, of course, go shopping in some new leagues that weren’t as available before. So this does provide an increase in those numbers above. However, as we will see, Championship clubs don’t seem ready to use those markets as this particular moment in time.

The smartest clubs will, of course, have adapted to this situation already. The problem is that when the smart clubs, and then the big clubs, have finished their fishing then the pond is so empty that there is little in the way of quality or value for the remainder. This is precisely why organisation, decisiveness and having a well functioning recruitment system is so important.

How has this affected Championship transfer business?

Firstly, we need to address the issue that Brexit/GBE rules are not the only reason for the reduction in transfer activity that we are about to see. The global pandemic, the reduction of income that has come into clubs, the uncertainty about the future, FFP regulations and ever-increasing wages are all factors that have had a say in the slowing of the transfer market in the EFL in particular.

The data used in the following report comes from Transfermarkt and uses only permanent transfers. No loan deals have been included, either domestic or foreign.

- Fewer players being recruited

With two weeks to go until the transfer window closes there is obviously still time to bring these numbers up but there is a definite trend of fewer players coming into Championship clubs. From the nadir of 17/18 where 215 players came into the 24 clubs (average of 8.95 per club) last season this was down at 132 (5.5 per club). At the moment we are at 84 players that have been contracted by clubs in the Championship, an average of 3.5 per club.

2. Much less money being spent on transfer fees

As you would expect, with fewer players being traded this has led to a reduction in the amount of money that is being spent on transfers each season since 17/18.

From a high of over £250m spent in the Championship in 17/18 (£10.6m per club) the amount of money spent has reduced significantly in the post-Brexit, post-COVID era. Albeit we are still discussing a very small sample size (three transfer windows) it seems like a pattern is emerging.

2017/18 was the season of Wolves’ title win, which included a £16m buy of Ruben Neves, but also Middlesbrough bought Britt Assombalonga and Sheffield Wednesday bought Jordan Rhodes for £15m and £10m respectively. There were big fees paid all around the markets. Purchases from League Two that season totalled over £10m, Championship-to-Championship transfers went over £100m, Norwich spent £7m in the 2.Bundesliga, and over £20m was spent on strikers from Ligue 1 (including another £10m from Boro on Martin Braithwaite).

2020/21 saw a total spend of only £70.9m total in the Championship, which equates to £2.95m per club. This is a reduction of 72% from 17/18 and 64% from the previous season 2019/20. The current transfer window is on course for an even lower spend, currently sitting at £27.1m, £12m of which is taken up by the Harry Wilson to Fulham signing alone.

3. Less money spent per player

Combining the two trends together, despite the fact that overall spend is considerably down, the amount of money spent per player is also trending downwards.

The peak of money spent per player was in 2018/19 as clubs spent £1.57m per player. This was the season of Joao Carvalho to Forest for £13.5m, Peter Etebo to Stoke for £6.5m, Lovre Kalinic to Villa for £5.4m, Aden Flint & George Saville to Boro for over £7m each, Bamford to Leeds for £8m, Ryan Woods & Sam Clucas to Stoke for £6m each. These are (generally) fees that even only 3 years later look ridiculously exorbitant.

Season 2020/21 saw a big reduction to £540k per player, at the moment the 2021 summer transfer window has seen clubs spending on average £325k per player in fees. Obviously, this does not take into account wage spend. However, it is clear that many more deals are being done at the end of contracts, either as total freebies or at a much reduced initial fee as a result of players being near the end of their contracts.

4. Increase in percentage of domestic business

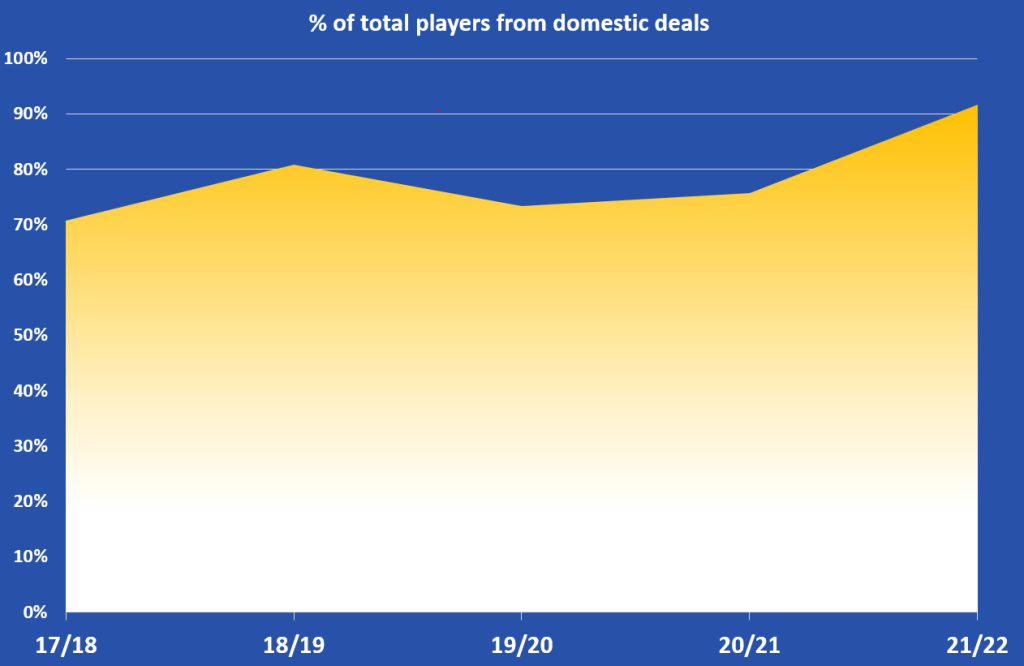

One aspect of the Brexit/GBE situation that I wanted to look into was how things had changed within the markets since the GBE requirements had come into play in 2021.

Three-quarters of player moves to the Championship had been domestic across the last few years until the GBE requirements came into play. This current window has so far seen 92% of all player moves within the UK & Ireland. Obviously this is 92% of a much smaller total number of players as we have seen above.

The winter transfer window of 2020/21 was when the GBE rules first came into practice so it is possible to take the business solely from the two transfer windows so far and compare. From 17/18 to Summer 2020, the percentage of player moves that would be classed as domestic was 74%. This has now changed to 91% post GBE rules, an increase of 17%.

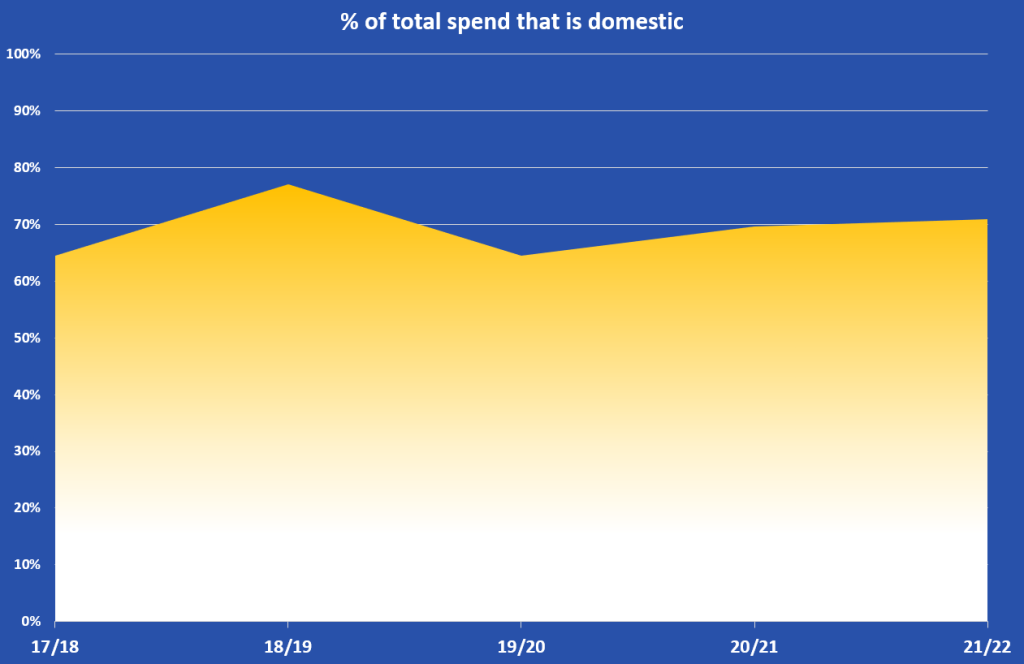

So far, however, there has been little change in the proportion of money spent that is going to the domestic market over the foreign market. Yes, it is a much smaller amount either way than in the recent past, but the ratio has yet to change.

However, the business in the 21/22 window so far has been heavily dependent on only two transfer deals, the aforementioned Harry Wilson to Fulham deal and the Martin Payero to Middlesbrough deal. These two transfers practically alone provide the balance you see in the 21/22 figures. We will obviously need to see much more evidence before anything is conclusive.

Again, taking the 2021 windows in isolation: 2021 domestic spend totalled 76% of all business, whereas in the seven transfer windows before that domestic business made up 68%. This is an increase in domestic spend of 8%.

5. Where are the GBE requirements affecting the foreign markets the most?

This is perhaps the most pertinent item as regards to direct effect of GBE requirements on activity. The amount of money spent and the general number of transfers can be attributed to many factors, as outlined above, but this part of the study concentrates upon which areas of foreign markets have seen changes in the amount of business conducted.

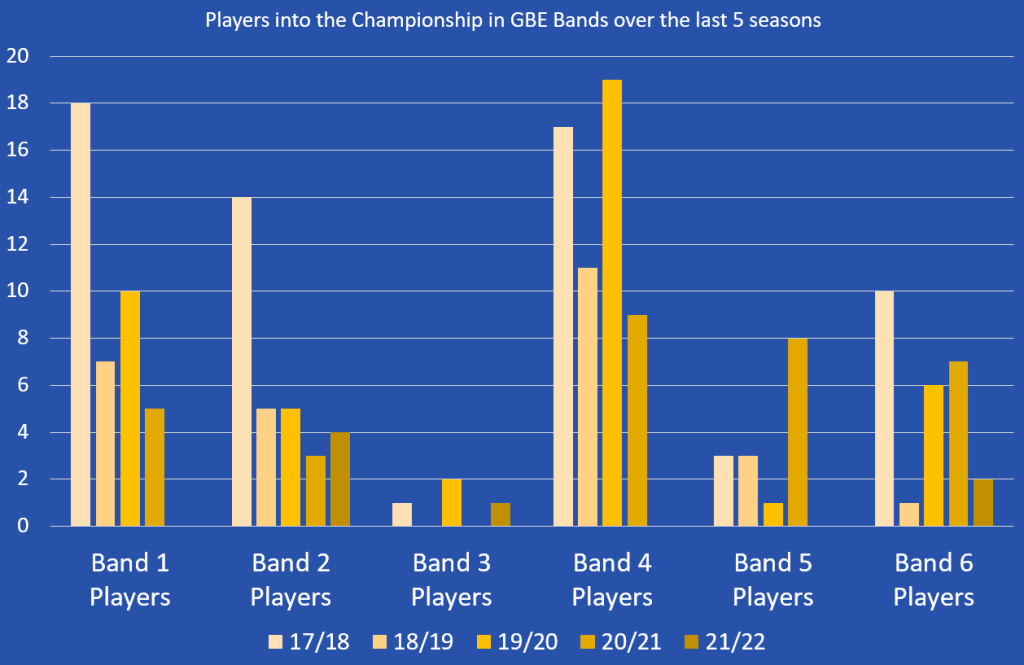

As detailed earlier we know that the leagues have been grouped into “Bands”. I was able to classify all transfer activity from 17/18 to now into those Bands to see the effect for each set of leagues, i.e. any transfers that took players from Ligue 1, La Liga, Bundesliga & Serie A would be classed as Band 1.

This graph illustrates how many players have been coming into the Championship from different leagues in the world. The fact is that across all territories is that since GBE requirements came in, only 7 foreign players have been brought into the Championship.

There was a general downward trend in the number of foreign players coming into the league before GBE as well. Looking at players from Band 1 and Band 2 leagues that is quite clear. However, it is also clear that clubs were continuing to look into more obscure markets (Band 4 – Band 6) and numbers of players coming in from those leagues were generally fairly strong in comparison to Band 1 and Band 2. Since GBE those Bands have been abandoned as it is almost impossible to bring in players from those leagues now.

It is still possible to bring in players from Band 3. However, as can be seen in the graph, these are territories that Championship clubs have never used and lack the knowledge and infrastructure at the moment to use those markets effectively. Yohan Mollo (Russia), Martin Payero (Argentina), Samba Sow (Russia) & Felipe Araruna (Brazil) are the only players to come in from Band 3 leagues to the Championship over the sample size.

Moving away from the players into the actual spending figures it is again interesting to see the amount of money that had been spent by Championship clubs in different areas. The players brought in from Band 1 and Band 2 (Holland, Belgium, Portugal, Turkey) came to quite a lot of money between 2017-2020. However, since 2020 the spend in those leagues has been minor or non-existant.

I find this fascinating because, technically, within the GBE rules these players are still available to the Championship clubs. This suggests that either the GBE rules are not the main reason so reduced spending, or that the bigger or smarter clubs are concentrating their own operations in the Band 1 and Band 2 leagues and keeping the Championship clubs frozen out of the better players and better deals. More evidence is required to find out exactly what is going on with it though.

The big disappointment for Championship clubs is clearly the Band 4 situation. In 2019/20 Championship clubs spent over £25 million in those leagues that are practically out of range now, unless some of the clubs progress well in European competition. Players brought in included the likes of Croatian League’s Ivan Sunjic (£7m to Birmingham) and Simon Sluga (£1.5m to Luton) and Ligue 2’s Bryan Mbuemo (£5.5m to Brentford) and Brice Samba (£1.75m to Forest). All of the investment that Championship clubs had clearly been putting into these interesting markets was coming to fruition and has now been snubbed on the whole.

Even Band 5 leagues were seeing a lot more activity in terms of money. In 20/21 over £10m was spent in those markets that are definitely now out of reach, except in exceptional circumstances. £7m of that money came from investment in the Polish Ekstraklasa in the shape of Kamil Jozwiak (£3.75m to Derby), Premyslaw Placheta (£2.7m to Norwich) and Michal Helik (£700k to Barnsley). It is difficult to see where investment in these leagues will come from now, a shame for operations who smartly identified talent early.

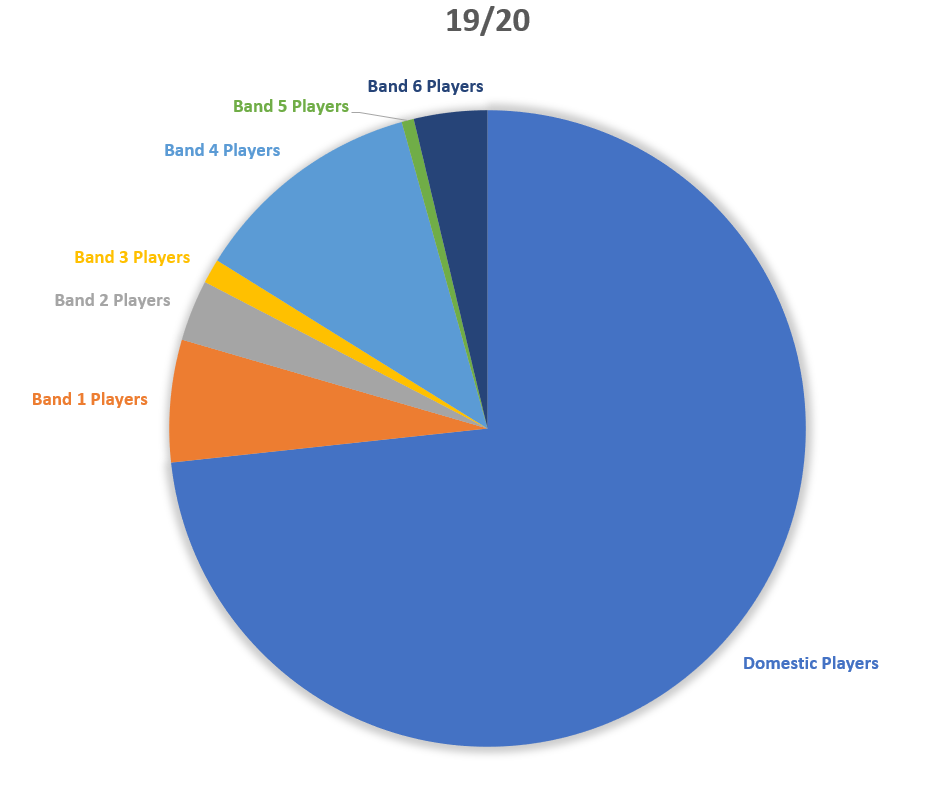

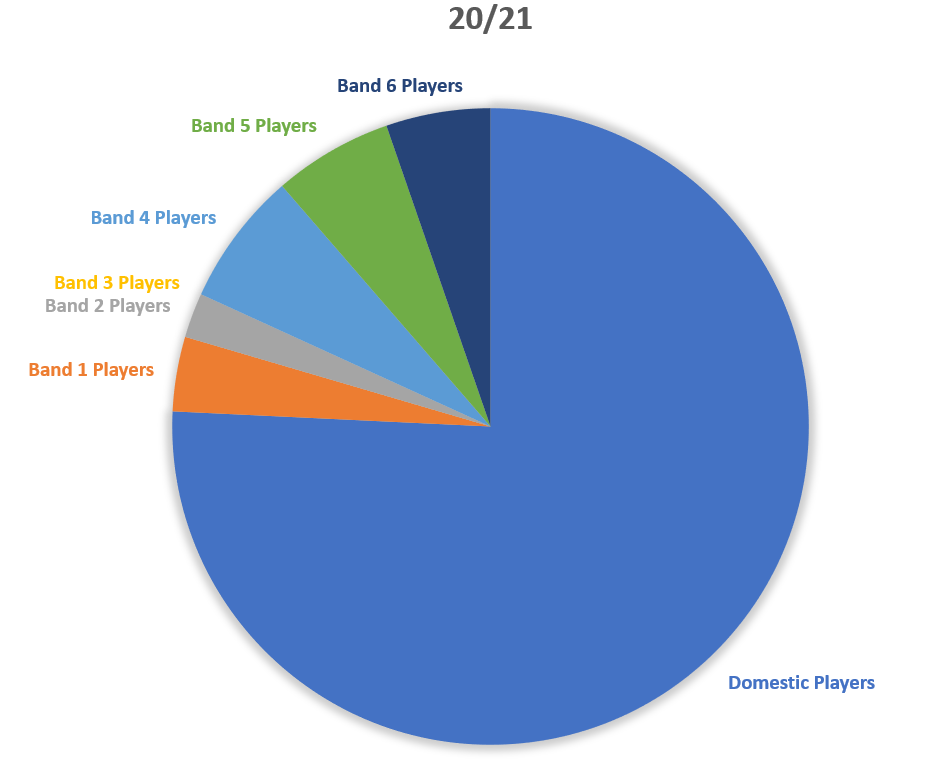

Finally, I will just display some pie charts that represent where the players have come from that have been transferred in by Championship clubs over the last five seasons. It works as a summation of what has been discussed above.

What next?

I will produce updates on this topic at the end of the transfer window to see how it shapes up after deadline day. It is fascinating to see the changing landscape in the division. There seems to be just as much money in the game as ever in the Premier League, but the tightening of the purse strings in the Championship cannot be denied. There is a definite change of tactics in the division around recruitment and a comparison between incomings and outgoings appears to be a good idea for an investigation. The way that Brentford have been able to scale up their operations on the back of smart player trading appears to have stimulated this change, as well as, perhaps, FFP restrictions.

There is certainly much to investigate and learn from in these figures. For those who wish to see the raw data I will dump the tables that the above charts came from as an appendix below.

Appendix – Transfer Data

| Season | Players In | Total Spent | Money Spent per Player | Domestic Players | % of total players from domestic deals | Domestic Spend | % of total spend that is domestic | Band 1 Players | Band 1 Spend | Band 2 Players | Band 2 Spend | Band 3 Players | Band 3 Spend | Band 4 Players | Band 4 Spend | Band 5 Players | Band 5 Spend | Band 6 Players | Band 6 Spend |

| 17/18 | 215 | 255094000 | 1186483.721 | 152 | 71% | 164606000 | 65% | 18 | 28220000 | 14 | 36370000 | 1 | 0 | 17 | 17330000 | 3 | 3240000 | 10 | 5328000 |

| 18/19 | 141 | 203530000 | 1443475.177 | 114 | 81% | 156985000 | 77% | 7 | 10800000 | 5 | 27810000 | 0 | 0 | 11 | 7880000 | 3 | 0 | 1 | 55000 |

| 19/20 | 161 | 196267000 | 1219049.689 | 118 | 73% | 126617000 | 65% | 10 | 35820000 | 5 | 3900000 | 2 | 630000 | 19 | 27230000 | 1 | 1800000 | 6 | 270000 |

| 20/21 | 132 | 70963000 | 537598.4848 | 100 | 76% | 49390000 | 70% | 5 | 4500000 | 3 | 1800000 | 0 | 0 | 9 | 3240000 | 8 | 10593000 | 7 | 1440000 |

| 21/22 | 84 | 27120000 | 322857.1429 | 77 | 92% | 19240000 | 71% | 0 | 0 | 4 | 1800000 | 1 | 6080000 | 0 | 0 | 0 | 0 | 2 | 0 |

| Post GBE | 124 | 32316000 | 260612.9032 | 113 | 91% | 24436000 | 76% | 0 | 0 | 4 | 1800000 | 1 | 6080000 | 1 | 0 | 0 | 0 | 5 | 0 |

| 17/18 | Number of Players In | Amount Spent |

| Premier League | 27 | 37560000 |

| Championship | 59 | 100490000 |

| League One | 32 | 9610000 |

| League Two | 12 | 10260000 |

| National League | 4 | 558000 |

| Scot PL | 10 | 5660000 |

| Scot CH | 1 | 306000 |

| Scot L1 | 1 | 0 |

| Ireland | 6 | 162000 |

| Domestic | 152 | 164606000 |

| Ligue 1 | 9 | 23670000 |

| Bundesliga | 3 | 450000 |

| La Liga | 2 | 0 |

| Serie A | 4 | 4100000 |

| Band 1 | 18 | 28220000 |

| Eredivisie | 6 | 5580000 |

| Belgium | 4 | 4770000 |

| Turkey | 1 | 1030000 |

| Portugal | 3 | 24990000 |

| Band 2 | 14 | 36370000 |

| Band 3 | 1 | 0 |

| Band 4 | 17 | 17330000 |

| Band 5 | 3 | 3240000 |

| Band 6 | 10 | 5328000 |

| Total | 215 | 255094000 |

| 18/19 | Number of Players In | Amount Spent |

| Premier League | 23 | 59790000 |

| Championship | 42 | 66060000 |

| League One | 36 | 21220000 |

| League Two | 6 | 2500000 |

| National League | 1 | 0 |

| Scot PL | 4 | 7100000 |

| Scot CH | 0 | 0 |

| Ireland | 1 | 315000 |

| N.Ireland | 1 | 0 |

| Domestic | 114 | 156985000 |

| Ligue 1 | 3 | 7830000 |

| Bundesliga | 1 | 1350000 |

| La Liga | 2 | 1350000 |

| Serie A | 1 | 270000 |

| Band 1 | 7 | 10800000 |

| Eredivisie | 1 | 360000 |

| Belgium | 1 | 5400000 |

| Turkey | 0 | 0 |

| Portugal | 3 | 22050000 |

| Band 2 | 5 | 27810000 |

| Band 3 | 0 | 0 |

| Band 4 | 11 | 7880000 |

| Band 5 | 3 | 0 |

| Band 6 | 1 | 55000 |

| Total | 141 | 203530000 |

| 19/20 | Number of Players In | Amount Spent |

| Premier League | 24 | 50360000 |

| Championship | 48 | 60310000 |

| League One | 31 | 13290000 |

| League Two | 8 | 923000 |

| National League | 1 | 104000 |

| Scot PL | 5 | 1630000 |

| Scot CH | 0 | |

| Ireland | 1 | |

| N.Ireland | ||

| Domestic | 118 | 126617000 |

| Ligue 1 | 3 | 20250000 |

| Bundesliga | 0 | |

| La Liga | 3 | 3870000 |

| Serie A | 4 | 11700000 |

| Band 1 | 10 | 35820000 |

| Eredivisie | 3 | 3900000 |

| Belgium | 1 | |

| Turkey | 0 | |

| Portugal | 1 | |

| Band 2 | 5 | 3900000 |

| Band 3 | 2 | 630000 |

| Band 4 | 19 | 27230000 |

| Band 5 | 1 | 1800000 |

| Band 6 | 6 | 270000 |

| Total | 161 | 196267000 |

| 20/21 | Number of Players In | Amount Spent |

| Premier League | 15 | 16170000 |

| Championship | 35 | 10780000 |

| League One | 36 | 15490000 |

| League Two | 4 | 0 |

| National League | 1 | 0 |

| Scot PL | 7 | 6950000 |

| Scot CH | 1 | 0 |

| Ireland | 1 | 0 |

| N.Ireland | 0 | 0 |

| Domestic | 100 | 49390000 |

| Ligue 1 | 1 | 4500000 |

| Bundesliga | 0 | 0 |

| La Liga | 1 | 0 |

| Serie A | 3 | 0 |

| Band 1 | 5 | 4500000 |

| Eredivisie | 2 | 1350000 |

| Belgium | 1 | 450000 |

| Turkey | 0 | 0 |

| Portugal | 0 | |

| Band 2 | 3 | 1800000 |

| Band 3 | 0 | 0 |

| Band 4 | 9 | 3240000 |

| Band 5 | 8 | 10593000 |

| Band 6 | 7 | 1440000 |

| Total | 132 | 70963000 |

| 21/22 | Number of Players In | Amount Spent |

| Premier League | 11 | 14180000 |

| Championship | 31 | 3240000 |

| League One | 26 | 1820000 |

| League Two | 3 | 0 |

| National League | 2 | |

| Scot PL | 2 | |

| Scot CH | 1 | 0 |

| Ireland | 0 | |

| N.Ireland | 1 | 0 |

| Domestic | 77 | 19240000 |

| Ligue 1 | ||

| Bundesliga | ||

| La Liga | ||

| Serie A | ||

| Band 1 | ||

| Eredivisie | 1 | 1800000 |

| Belgium | 3 | |

| Turkey | ||

| Portugal | ||

| Band 2 | 4 | 1800000 |

| Band 3 | 1 | 6080000 |

| Band 4 | ||

| Band 5 | ||

| Band 6 | 2 | |

| Total | 84 | 27120000 |

| Post Brexit | Number of Players In | Amount Spent |

| Premier League | 14 | 14180000 |

| Championship | 41 | 3956000 |

| League One | 39 | 4270000 |

| League Two | 6 | 0 |

| National League | 3 | |

| Scot PL | 7 | 2030000 |

| Scot CH | 1 | 0 |

| Ireland | 1 | 0 |

| N.Ireland | 1 | 0 |

| Domestic | 113 | 24436000 |

| Ligue 1 | ||

| Bundesliga | ||

| La Liga | ||

| Serie A | ||

| Band 1 | ||

| Eredivisie | 1 | 1800000 |

| Belgium | 3 | |

| Turkey | ||

| Portugal | ||

| Band 2 | 4 | 1800000 |

| Band 3 | 1 | 6080000 |

| Band 4 | 1 | |

| Band 5 | ||

| Band 6 | 5 | |

| Total | 124 | 32316000 |